Banking Systems : A Quick Overview

https://www.linkedin.com/in/bharatkul/recent-activity/articles/

Banking systems are the backbone of the financial industry, providing essential services to individuals, businesses, and governments worldwide. These systems encompass a wide range of functions and technologies that enable the management of money, the facilitation of transactions, and the provision of financial products and services.

𝐄𝐯𝐨𝐥𝐮𝐭𝐢𝐨𝐧 𝐨𝐟 𝐁𝐚𝐧𝐤𝐢𝐧𝐠 𝐒𝐲𝐬𝐭𝐞𝐦𝐬 :

The concept of banking dates back thousands of years, with early forms of banking emerging in ancient civilizations such as Mesopotamia, Egypt, and Greece. However, modern banking systems have evolved significantly over the centuries, driven by technological advancements, regulatory changes, and shifts in consumer behavior.

𝙊𝙫𝙚𝙧𝙫𝙞𝙚𝙬 𝙤𝙛 𝘽𝙖𝙣𝙠𝙞𝙣𝙜 𝙚𝙫𝙤𝙡𝙪𝙩𝙞𝙤𝙣 𝙖𝙣𝙙 𝙛𝙞𝙣𝙖𝙣𝙘𝙞𝙖𝙡 𝙨𝙚𝙧𝙫𝙞𝙘𝙚𝙨 𝙤𝙛𝙛𝙚𝙧𝙚𝙙 𝙞𝙣 𝙙𝙞𝙛𝙛𝙚𝙧𝙚𝙣𝙩 𝙚𝙧𝙖

𝐅𝐮𝐧𝐜𝐭𝐢𝐨𝐧𝐬 𝐨𝐟 𝐁𝐚𝐧𝐤𝐢𝐧𝐠 𝐒𝐲𝐬𝐭𝐞𝐦𝐬 :

Banking systems perform several key functions that are essential for the functioning of the economy:

Accepting Deposits: Banks accept deposits from individuals and businesses, providing a safe place to store money and earn interest.

Lending Money: Banks lend money to borrowers in the form of loans, mortgages, and credit lines, enabling individuals and businesses to finance their activities and investments.

Facilitating Payments: Banking systems facilitate the transfer of funds between accounts, both domestically and internationally, through various payment channels such as wire transfers, electronic funds transfers (EFTs), and payment cards.

Issuing Currency: Central banks, which are part of the banking system, issue currency and regulate the money supply to maintain price stability and support economic growth.

Managing Investments: Banks offer investment services such as wealth management, asset management, and brokerage services to help individuals and institutions grow their wealth and achieve their financial goals.

𝐂𝐨𝐦𝐩𝐨𝐧𝐞𝐧𝐭𝐬 𝐨𝐟 𝐁𝐚𝐧𝐤𝐢𝐧𝐠 𝐒𝐲𝐬𝐭𝐞𝐦𝐬:

Modern banking systems comprise various components, including:

Core Banking Systems: The central platform that manages essential banking functions such as customer accounts, transactions, loans, and deposits.

Payment Systems: Infrastructure and networks that enable the processing and settlement of payments between banks and their customers.

Risk Management Systems: Tools and processes to identify, assess, and mitigate various types of risks, including credit risk, market risk, operational risk, and compliance risk.

Compliance and Regulatory Frameworks: Policies, procedures, and controls to ensure compliance with regulatory requirements and standards set by governing authorities.

Customer Relationship Management (CRM) Systems: Software platforms that manage interactions with customers, track customer preferences, and analyze customer data to improve customer experiences and retention.

𝐂𝐡𝐚𝐥𝐥𝐞𝐧𝐠𝐞𝐬 𝐚𝐧𝐝 𝐎𝐩𝐩𝐨𝐫𝐭𝐮𝐧𝐢𝐭𝐢𝐞𝐬:

While banking systems play a crucial role in supporting economic activities and fostering financial inclusion, they also face numerous challenges, including cybersecurity threats, regulatory complexities, and competition from non-traditional players such as fintech startups and neobanks.

However, these challenges also present opportunities for innovation and growth. Banks are increasingly embracing digital transformation initiatives, adopting new technologies such as artificial intelligence, blockchain, and cloud computing to enhance efficiency, improve customer experiences, and stay competitive in the digital age.

𝐂𝐨𝐧𝐜𝐥𝐮𝐬𝐢𝐨𝐧:

In conclusion, banking systems form the foundation of the global financial infrastructure, providing vital services that support economic growth and development. As technology continues to evolve and customer expectations evolve, banking systems must adapt and innovate to meet the changing needs of consumers and businesses while maintaining trust, security, and regulatory compliance.

𝑭𝒆𝒆𝒍 𝒇𝒓𝒆𝒆 𝒕𝒐 𝒂𝒅𝒅 𝒔𝒖𝒈𝒈𝒆𝒔𝒕𝒊𝒐𝒏𝒔 𝒐𝒓 𝒔𝒉𝒂𝒓𝒆 𝒚𝒐𝒖𝒓 𝒊𝒏𝒑𝒖𝒕𝒔 𝒐𝒏 𝒉𝒐𝒘 𝒃𝒂𝒏𝒌𝒊𝒏𝒈 𝒔𝒚𝒔𝒕𝒆𝒎𝒔 𝒄𝒂𝒏 𝒇𝒖𝒓𝒕𝒉𝒆𝒓 𝒆𝒗𝒐𝒍𝒗𝒆 𝒕𝒐 𝒎𝒆𝒆𝒕 𝒇𝒖𝒕𝒖𝒓𝒆 𝒄𝒉𝒂𝒍𝒍𝒆𝒏𝒈𝒆𝒔 𝒂𝒏𝒅 𝒐𝒑𝒑𝒐𝒓𝒕𝒖𝒏𝒊𝒕𝒊𝒆𝒔. 𝒀𝒐𝒖𝒓 𝒊𝒏𝒔𝒊𝒈𝒉𝒕𝒔 𝒂𝒓𝒆 𝒗𝒂𝒍𝒖𝒂𝒃𝒍𝒆 𝒊𝒏 𝒔𝒉𝒂𝒑𝒊𝒏𝒈 𝒕𝒉𝒆 𝒇𝒖𝒕𝒖𝒓𝒆 𝒐𝒇 𝒇𝒊𝒏𝒂𝒏𝒄𝒆.

Understanding Core Banking Systems

𝐁𝐚𝐜𝐤𝐠𝐫𝐨𝐮𝐧𝐝: 𝐓𝐡𝐞 𝐄𝐯𝐨𝐥𝐮𝐭𝐢𝐨𝐧 𝐨𝐟 𝐁𝐚𝐧𝐤𝐢𝐧𝐠 𝐎𝐩𝐞𝐫𝐚𝐭𝐢𝐨𝐧𝐬

Before the emergence of core banking systems, the banking landscape was characterized by decentralized operations and manual processes. Each branch of a bank operated independently, maintaining its own set of records and processes. This fragmented approach led to various challenges, including limited accessibility for customers, delayed transactions, inconsistent information across branches, and compliance difficulties. Banks struggled to offer a diverse range of products and services, and the risk of fraud and errors was higher due to manual processes.

𝐈𝐧𝐭𝐫𝐨𝐝𝐮𝐜𝐭𝐢𝐨𝐧 𝐨𝐟 𝐂𝐨𝐫𝐞 𝐁𝐚𝐧𝐤𝐢𝐧𝐠 𝐒𝐲𝐬𝐭𝐞𝐦𝐬: 𝐑𝐞𝐯𝐨𝐥𝐮𝐭𝐢𝐨𝐧𝐢𝐳𝐢𝐧𝐠 𝐁𝐚𝐧𝐤𝐢𝐧𝐠 𝐎𝐩𝐞𝐫𝐚𝐭𝐢𝐨𝐧𝐬

In response to these challenges, core banking systems emerged as a transformative solution. These systems introduced centralized, integrated platforms that streamlined banking operations and enhanced customer service. Core banking systems consolidated data and processes across branches, enabling real-time transaction processing, unified customer experiences, and improved regulatory compliance. With core banking systems, banks could offer a wider range of products and services, enhance security measures, and detect fraudulent activities more effectively.

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐂𝐨𝐫𝐞 𝐁𝐚𝐧𝐤𝐢𝐧𝐠 𝐒𝐲𝐬𝐭𝐞𝐦?

A core banking system acts as the Central Hub of a bank’s operations, handling numerous essential tasks required for daily functioning. It serves as the backbone, overseeing critical functions such as tracking incoming and outgoing funds, managing customer accounts, and ensuring smooth operations. Essentially, it functions as the lifeline of the bank, ensuring seamless operations and facilitating easy banking for customers.

Core banking encompasses a backend system that integrates multiple branches of the same bank, allowing for real-time operations such as loan management, withdrawals, deposits, and payments.

𝐖𝐡𝐚𝐭 𝐝𝐨𝐞𝐬 𝐜𝐨𝐫𝐞 𝐛𝐚𝐧𝐤𝐢𝐧𝐠 𝐦𝐞𝐚𝐧?

The term “CORE” represents Centralized Online Real-time Environment, highlighting the integration of bank branches into a unified platform. This integration ensures that customers can access banking services seamlessly from any location, enhancing convenience and accessibility.

The following chart illustrates the clear contrast between the challenges encountered prior to the Core Banking Era and the solutions provided by Core Banking systems to address these challenges.

𝐊𝐞𝐲 𝐅𝐮𝐧𝐜𝐭𝐢𝐨𝐧𝐬 𝐨𝐟 𝐂𝐨𝐫𝐞 𝐁𝐚𝐧𝐤𝐢𝐧𝐠 𝐒𝐲𝐬𝐭𝐞𝐦𝐬

Core banking systems undertake various fundamental responsibilities crucial for the smooth functioning of financial institutions. Lets summarize the key functions offered by Core Banking System. By centralizing these functions, core banking systems ensure accuracy, reliability, and efficiency in banking operations.

Key Functions CBS

𝐇𝐨𝐰 𝐂𝐨𝐫𝐞 𝐁𝐚𝐧𝐤𝐢𝐧𝐠 𝐖𝐨𝐫𝐤𝐬

Core banking operates through back-end servers that manage typical tasks such as interest calculation, passbook maintenance, and withdrawals. For instance, when a customer initiates a transaction at a branch or ATM, the core banking system processes the request in real-time, ensuring seamless authentication and completion of the transaction.

𝐅𝐞𝐚𝐭𝐮𝐫𝐞𝐬 𝐨𝐟 𝐂𝐨𝐫𝐞 𝐁𝐚𝐧𝐤𝐢𝐧𝐠 𝐒𝐲𝐬𝐭𝐞𝐦𝐬

Beyond its foundational functions, core banking systems often incorporate additional features to enhance the banking experience for customers:

- Online Banking: With online banking capabilities integrated into the core system, customers can access their accounts remotely, perform transactions, and manage their finances conveniently through web-based platforms.

- Mobile Banking: Mobile banking applications extend the reach of banking services further by allowing customers to access their accounts, transfer funds, and pay bills directly from their smartphones or tablets, providing unparalleled convenience and accessibility.

- ATM Management: Core banking systems also govern Automated Teller Machines (ATMs), enabling customers to carry out various transactions, including cash withdrawals, deposits, and balance inquiries, round the clock, and across diverse locations.

- Multi-Channel Support: Core banking systems often support multiple channels beyond online and mobile banking, including telephone banking, SMS banking, and even emerging channels such as chatbots and social media platforms, ensuring customers can interact with the bank through their preferred channels.

- Transaction Monitoring and Fraud Detection: Advanced core systems incorporate robust transaction monitoring and fraud detection capabilities, leveraging algorithms and machine learning techniques to detect suspicious activities and protect customers from fraudulent transactions.

- Alerts and Notifications: Banks leverage core systems to send real-time alerts and notifications to customers, keeping them informed about important account activities, such as low balances, large transactions, or upcoming bill payments, enhancing security and financial awareness.

- Account Aggregation: Core banking systems may offer account aggregation services, enabling customers to view and manage accounts held at multiple financial institutions through a single interface, providing a holistic view of their finances.

- Analytics and Reporting: Core systems provide tools for analytics and reporting, allowing banks to analyze customer behavior, track key performance indicators, and generate insights to inform strategic decisions, such as product development and marketing campaigns.

- Integration with Third-Party Services: Core banking systems often support integration with third-party services, such as payment gateways, credit bureaus, and financial aggregators, enabling banks to offer additional services and enhance the overall banking experience for customers.

As core banking trends continue to advance, the market is set for substantial growth. The rising acceptance of digital transformation, cloud services, open banking initiatives, and innovative technologies like artificial intelligence and blockchain are all playing a part in expanding the global core banking software market.

What sets apart Retail Banking from Core Banking Systems?

Core banking systems primarily manage crucial financial services like deposit and loan processing, interest calculation, and customer relationship management. On the other hand, retail banking encompasses core banking functions alongside supplementary services such as mortgages, personal loans, and various retail products, directly targeting consumers.

Refer to the table below for a comprehensive overview of the key distinctions between retail banking and core banking systems.

𝐓𝐡𝐞 𝐅𝐮𝐭𝐮𝐫𝐞 𝐨𝐟 𝐂𝐨𝐫𝐞 𝐁𝐚𝐧𝐤𝐢𝐧𝐠 𝐒𝐲𝐬𝐭𝐞𝐦𝐬

As core banking trends continue to advance, the market is poised for substantial growth. Factors such as digital transformation, cloud services, open banking initiatives, and innovative technologies like artificial intelligence and blockchain are driving the expansion of the global core banking software market. With continuous advancements, core banking systems will play a pivotal role in shaping the future of banking, offering enhanced functionalities and experiences to meet evolving customer needs.

Now, let’s understand the statistics concerning the global market share of core banking.

Fortune Business Insight

The market segments into small banks, midsize banks, large banks, community banks, and credit unions based on banking type. Forecasts suggest that the large bank segment will lead the core banking software market share during the projection period. This surge is attributed to the heightened use of interconnected devices and internet-based monitoring of banking operations. Community banks are anticipated to experience notable growth, driven by the imperative to improve operational efficiency. Furthermore, increased adoption of advanced core banking software among midsize banks, small banks, and credit unions is expected to propel market growth.

𝐈𝐧 𝐂𝐨𝐧𝐜𝐥𝐮𝐬𝐢𝐨𝐧

The core banking system serves as the cornerstone of a bank’s infrastructure, orchestrating vital functions and services that underpin its operations. From recording financial transactions to managing customer accounts, its role is indispensable in ensuring the seamless functioning and efficiency of the institution. With the integration of features like online and mobile banking, core banking systems not only streamline banking operations but also elevate the customer experience, making banking more accessible, convenient, and user-friendly than ever before.

𝑻𝒐 𝒆𝒏𝒓𝒊𝒄𝒉 the quality of this article, we encourage 𝒓𝒆𝒂𝒅𝒆𝒓𝒔 𝒕𝒐 𝒄𝒐𝒏𝒕𝒓𝒊𝒃𝒖𝒕𝒆 𝒕𝒉𝒆𝒊𝒓 𝒊𝒏𝒔𝒊𝒈𝒉𝒕𝒔, 𝒔𝒖𝒈𝒈𝒆𝒔𝒕𝒊𝒐𝒏𝒔, 𝒂𝒏𝒅 𝒇𝒆𝒆𝒅𝒃𝒂𝒄𝒌. If you found the information helpful, 𝒌𝒊𝒏𝒅𝒍𝒚 𝒄𝒐𝒏𝒔𝒊𝒅𝒆𝒓 𝒔𝒉𝒐𝒘𝒊𝒏𝒈 𝒚𝒐𝒖𝒓 𝒔𝒖𝒑𝒑𝒐𝒓𝒕 𝒃𝒚 𝒍𝒊𝒌𝒊𝒏𝒈 𝒕𝒉𝒆 𝒂𝒓𝒕𝒊𝒄𝒍𝒆.. Your valuable input and active participation in the discussion on “𝑼𝒏𝒅𝒆𝒓𝒔𝒕𝒂𝒏𝒅𝒊𝒏𝒈 𝑪𝒐𝒓𝒆 𝑩𝒂𝒏𝒌𝒊𝒏𝒈 𝑺𝒚𝒔𝒕𝒆𝒎𝒔” are highly appreciated.

If you haven’t read the previous article, please find the link below for reference.

# Core Banking Handbook Article 1

Introduction to Core Banking Payments

Core banking payments are fundamental to the financial ecosystem, enabling seamless transactions between individuals, businesses, and financial institutions. These payments form the backbone of the banking industry, facilitating the exchange of goods, services, and fulfilling legal obligations. Understanding the intricacies of core banking payments is essential for navigating the modern financial landscape.

What is Payment?

A payment is the transfer of money or value from one party to another. It is a fundamental financial activity that facilitates trade and economic interaction. Payments can occur in various forms, including cash transactions, electronic transfers, and digital payments.

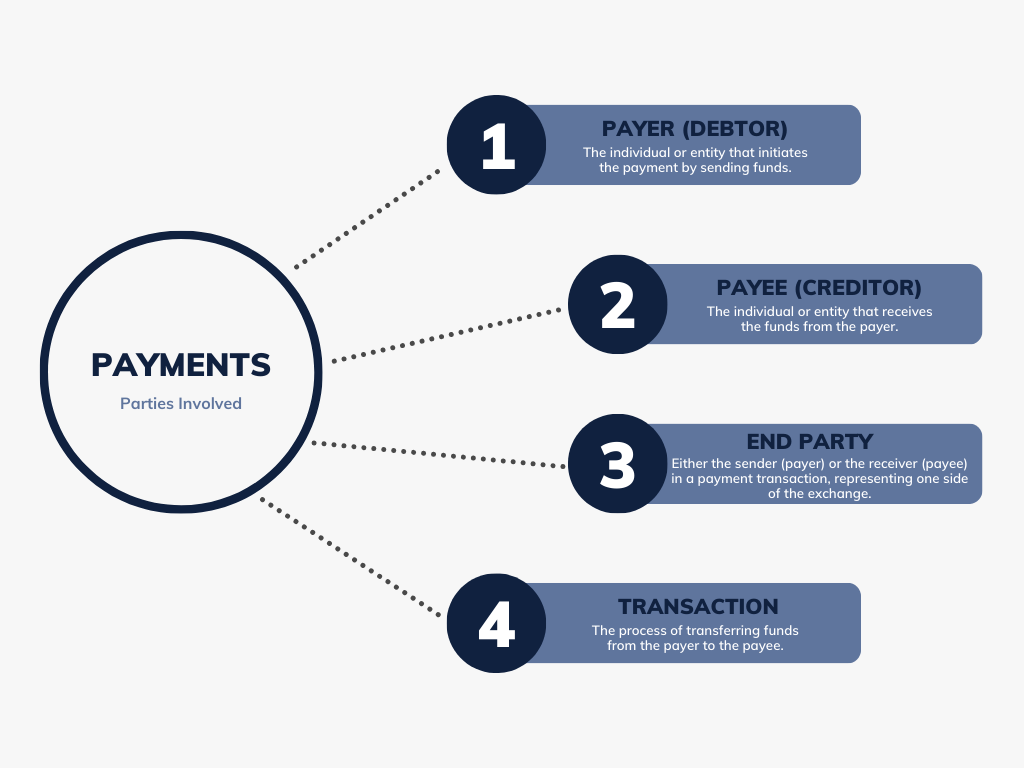

Various parties involved in payments are as below.

Types of Core Banking Payments

Understanding the different types of core banking payments is crucial for grasping the full scope of the financial ecosystem:

1. Domestic vs. International Payments:

- Domestic Payments: Transactions within the same country, typically faster and less expensive, processed through national payment systems.

- International Payments: Cross-border transactions involving currency conversion, higher fees, and longer processing times, facilitated by global networks like SWIFT.

2. Methods of Payment:

- Cash: Direct and immediate, but becoming less common with digital advancements.

- Credit/Debit Cards: Convenient and widely accepted, offering security and rewards.

- Bank Transfers: Secure and reliable for large transactions, executed through core banking systems.

- Mobile Payments: Growing in popularity with apps like Apple Pay and Google Wallet, integrated with core banking systems.

- Digital Wallets: PayPal, Venmo, and similar services provide easy online and peer-to-peer payments, often linked to bank accounts.

- Cryptocurrencies: Digital or virtual currencies that use cryptography for security.

3. Online vs. Offline Payments:

- Online Payments: E-commerce transactions requiring digital payment methods integrated with core banking systems.

- Offline Payments: In-person transactions using cash, cards, or mobile wallets, processed through banking infrastructure.

What are Payment Systems?

Payment systems are the mechanisms established to facilitate the transfer of money.

Global payment systems are as below.

Payment Process in Core Banking

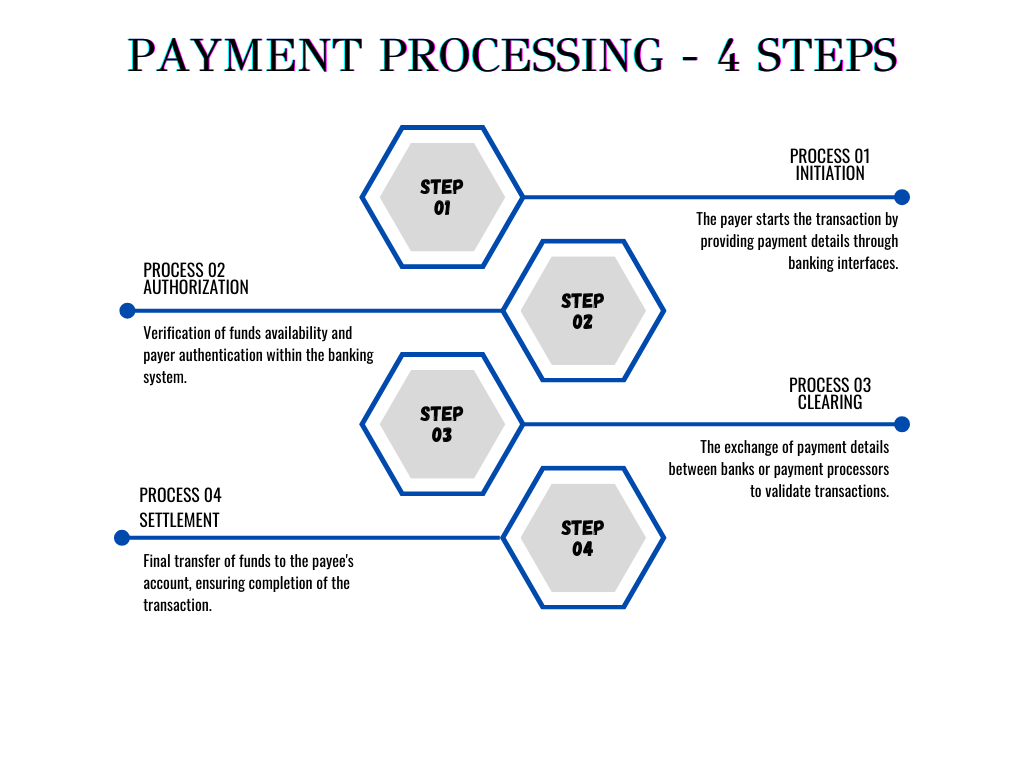

The payment process in core banking involves several critical steps to ensure smooth transactions:

Key Players in the Core Banking Payment Ecosystem

Various entities collaborate to facilitate core banking payments:

- Banks and Financial Institutions: Provide essential services like account management, transaction processing, and security.

- Payment Gateways and Processors: Authorize and process online transactions, ensuring secure and swift payments through core banking systems.

- Regulatory Bodies: Organizations that oversee and regulate payment systems to ensure security and efficiency.

- FinTech Companies: Innovate and streamline payment processes, offering new solutions like peer-to-peer payments and blockchain-based transactions, integrated with traditional banking systems.

How International Payment systems functions . Lets try to understand around the same.

International Payment Systems in Core Banking

International payments introduce additional complexities and systems:

- SWIFT: A global messaging network that ensures secure and standardized communication between banks for international transactions.

- Nostro and Vostro Accounts: Facilitate international transactions by maintaining balances in foreign currencies, essential for cross-border payments.

- Cross-border Payment Challenges: Currency conversion, higher fees, and compliance with different regulations, all managed through robust core banking systems.

Payment Security and Compliance

Ensuring the security and compliance of payments is paramount:

- Security Measures: Encryption, tokenization, and fraud prevention technologies protect transactions.

- Regulations: Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements ensure legal compliance.

- Compliance Standards: PCI DSS (Payment Card Industry Data Security Standard) mandates security measures for card transactions.

Trends and Future of Payments

The future of payments is shaped by digital transformation and technological advancements:

- Digital Transformation: The shift towards digital payments is accelerating, driven by consumer demand and technological capabilities.

- Open Banking: Allows third-party providers to access bank accounts, fostering innovation and competition.

- The Role of AI and Machine Learning: Enhances fraud detection, personalized services, and operational efficiency.

Key Challenges in Payment Management for Banks

1. Banks face several critical challenges in managing payments:

- Security: Ensuring robust security measures to protect transactions and safeguard customer data from cyber threats and fraud.

- Compliance: Adhering to stringent regulatory standards imposed by local and international authorities to maintain legal and operational compliance.

- Transaction Speed: Meeting growing customer expectations for faster processing and settlement times to enhance service efficiency.

- Integration: Seamlessly integrating emerging payment technologies into existing banking systems without disrupting operations or compromising service reliability.

- Cost Management: Effectively managing transaction costs to maintain profitability while delivering efficient and cost-effective payment services.

2. How Fintech Companies Assist Banks in Overcoming Challenges

Fintech companies contribute significantly to overcoming these challenges through innovative solutions:

- Security Solutions: Developing cutting-edge encryption technologies and biometric authentication systems to bolster transaction security and protect sensitive data.

- RegTech Solutions: Offering regulatory technology solutions that automate compliance processes, ensuring banks adhere to regulatory requirements without manual intervention.

- Payment Platforms: Introducing advanced real-time payment platforms and mobile payment solutions that streamline transaction processing, improving overall speed and enhancing customer experience.

- API Integration: Providing open banking APIs that facilitate seamless integration of new payment technologies and services into banks’ existing infrastructure, promoting interoperability and innovation.

- Data Analytics: Leveraging big data analytics and artificial intelligence to analyze transaction patterns, detect anomalies, identify potential fraud, and optimize payment processes for efficiency and cost-effectiveness.

These collaborations between banks and fintech companies are pivotal in driving innovation and resilience in the ever-evolving landscape of payment management.

Case Study reference:

Case Study: Intesa Sanpaolo

Intesa Sanpaolo aimed to modernize technology, enhance customer experience, and reduce costs as part of its 2022-2025 Business Plan. This included launching isybank, a digital banking platform powered by Thought Machine’s Vault Core, tailored for digital-first customers. Partnering with Thought Machine, Intesa Sanpaolo swiftly launched isybank in June 2023. The platform migrated 300,000 customers within a year and offers digital cards, SEPA transfers, and flexible account plans via an intuitive mobile app. Isybank’s launch marks a milestone in Intesa Sanpaolo’s digital journey, enhancing agility through cloud strategies and setting new standards in customer-centric banking services.

For more details, visit the link

Case Study: Revoult

Deel, a US-based B2B SaaS company specializing in payroll and HR tech, needed to process global payments rapidly amid their rapid growth. They operate in 150+ countries, managing payments in 120+ currencies. Deel integrated Revolut Business’s international payments, Business API, and bulk payments. This allowed them to automate fund distribution to contractors worldwide, facilitating instant, fee-free withdrawals into contractors’ Revolut accounts.Revolut Business enabled Deel to significantly improve payment efficiency and customer satisfaction. Contractors benefited from instant withdrawals, enhancing trust and scalability for Deel’s global operations.

For more details, visit the link

Case Study: DBS Bank – Digital Transformation in Payments

DBS Bank in Singapore implemented a digital transformation initiative to streamline payment processes. They introduced DBS IDEAL, an online corporate banking platform that integrates cash management and trade finance services. This platform offers real-time payment capabilities, allowing businesses to initiate and track payments seamlessly. The initiative significantly reduced transaction times and enhanced overall customer satisfaction by providing greater transparency and control over financial operations.

For more details, visit the link

Case Study: BBVA – Global Payment Platform

BBVA, a leading Spanish bank, developed a global payment platform to simplify international transactions for its corporate clients. The platform leverages advanced technology to provide real-time FX rates, instant payment execution, and enhanced security features. By centralizing payment processing on a single platform, BBVA improved efficiency, reduced operational costs, and enhanced customer satisfaction through faster and more reliable cross-border payments.

For more details, visit the link

Conclusion

Core banking payments are integral to the functioning of the financial ecosystem, enabling secure and efficient transactions between parties. By understanding the basics of payments, their types, and the involved processes, one can appreciate the complexities and importance of core banking systems in supporting global economic activities. This foundational knowledge is crucial for navigating and leveraging modern financial services.

𝑻𝒐 𝒆𝒏𝒓𝒊𝒄𝒉 the quality of this article, we encourage 𝒓𝒆𝒂𝒅𝒆𝒓𝒔 𝒕𝒐 𝒄𝒐𝒏𝒕𝒓𝒊𝒃𝒖𝒕𝒆 𝒕𝒉𝒆𝒊𝒓 𝒊𝒏𝒔𝒊𝒈𝒉𝒕𝒔, 𝒔𝒖𝒈𝒈𝒆𝒔𝒕𝒊𝒐𝒏𝒔, 𝒂𝒏𝒅 𝒇𝒆𝒆𝒅𝒃𝒂𝒄𝒌. If you found the information helpful, 𝒌𝒊𝒏𝒅𝒍𝒚 𝒄𝒐𝒏𝒔𝒊𝒅𝒆𝒓 𝒔𝒉𝒐𝒘𝒊𝒏𝒈 𝒚𝒐𝒖𝒓 𝒔𝒖𝒑𝒑𝒐𝒓𝒕 𝒃𝒚 𝒍𝒊𝒌𝒊𝒏𝒈 𝒕𝒉𝒆 𝒂𝒓𝒕𝒊𝒄𝒍𝒆.. Your valuable input on “𝑼𝒏𝒅𝒆𝒓𝒔𝒕𝒂𝒏𝒅𝒊𝒏𝒈 𝑪𝒐𝒓𝒆 𝑩𝒂𝒏𝒌𝒊𝒏𝒈 Payment 𝑺𝒚𝒔𝒕𝒆𝒎𝒔” are highly appreciated.

If you haven’t read the previous article, please find the link below for reference.

# Core Banking Handbook Article 2

Modernizing Banking Legacy Core to Modern Platforms

In the fast-paced world of banking, staying ahead means embracing change. For many banks, this means moving away from the familiar but aging legacy core banking systems towards modern solutions that promise greater agility, efficiency, and innovation. While the journey may seem daunting, it offers a path towards a brighter future, one where banks can better serve their customers and thrive in the digital age.

The Challenge of Legacy Core Banking Systems:

Legacy core banking systems have served banks faithfully for decades, but they come with their own set of limitations. These monolithic systems are often slow to adapt to new technologies and customer demands, making it difficult for banks to innovate and stay competitive. Upgrading or customizing these systems can be costly and time-consuming, draining resources that could be better spent elsewhere.

The Promise of Modern Solutions:

Enter modern core banking solutions, designed with agility and flexibility in mind. These solutions leverage cutting-edge technologies such as cloud computing, artificial intelligence, and microservices architecture to deliver a host of benefits that legacy systems simply cannot match. From faster transaction processing to personalized customer experiences, modern solutions offer banks the tools they need to thrive in today’s digital landscape.

Key Criteria for Selecting a Modern Core Banking Solution:

- API-First Approach:Prioritize platforms that offer robust API capabilities, facilitating seamless integration with third-party applications and enabling the creation of innovative banking services.

- Microservices Architecture:Opt for solutions built on microservices architecture, allowing for modular development, scalability, and flexibility in adapting to evolving business needs.

- Cloud-Native Design:Choose platforms designed to operate natively in the cloud, offering benefits such as scalability, automatic backups, and cost efficiency.

- Security and Compliance:Ensure that the solution prioritizes security with robust encryption, access controls, and compliance with industry regulations such as ISO/IEC 27001 and PCI-DSS.

- Scalability and Performance:Look for platforms that can handle growing transaction volumes and provide high performance to deliver responsive customer experiences.

- Ease of Integration:Select solutions with easy integration capabilities, allowing seamless connectivity with existing systems and third-party applications.

- User Experience Focus:Prioritize platforms that prioritize user experience, offering intuitive interfaces and personalized banking experiences for customers.

- Agility and Time to Market:Choose solutions that enable rapid deployment of new features and services, allowing banks to stay competitive and adapt to market changes quickly.

- Cost-Effectiveness and ROI:Evaluate the solution’s overall affordability, including implementation, support, and customization expenses, to maximize returns.

- Vendor Support and Expertise: Consider the vendor’s reputation, support quality, and industry expertise for a productive partnership.

8 Steps Guide

A Wholistic View:

Transitioning from legacy core banking systems to modern solutions is more than just a technological upgrade; it’s a strategic decision that impacts every aspect of a bank’s operations. It requires careful consideration of factors such as cost, risk, and long-term viability, as well as a commitment to embracing change and driving innovation.

Gone are the days when banks could settle for a mere service provider for their core banking system. Today, it’s about finding a true partner – one that understands the intricacies of the banking industry, is aligned with your institution’s goals, and is committed to your success. Rather than just offering off-the-shelf solutions, a core partner works collaboratively with banks to deliver tailored, innovative, and secure technologies that meet their unique requirements.

Conclusion:

In conclusion, the journey from legacy core banking systems to modern solutions is a transformative one, marked by challenges, opportunities, and the promise of a brighter future. By approaching the transition with an open mind, a spirit of innovation, and a commitment to excellence, banks can chart a course towards sustained success and prosperity in the years to come.

Understanding Legacy Core Banking Systems and the Need for Modernization

Legacy core banking systems are the backbone of a bank’s critical operations, such as managing accounts, processing transactions, handling loans, and maintaining customer data. These systems, built decades ago using outdated technologies like COBOL and mainframes, have been reliable over time. However, they now struggle to meet the demands of today’s fast-paced digital banking environment, lacking the flexibility and speed needed to support modern services.

The growing complexity and limitations of these systems are driving banks to consider modernization as an essential step towards remaining competitive.

As banks consider the future of their legacy systems, they generally face three options:

- Limited Improvement: Some banks choose to make minor updates to extend the system’s life a bit longer. These could include patching security holes or adding small features, though large-scale changes are typically avoided due to risks and complexity. In my experience, I have witnessed how even minor improvements can temporarily alleviate some pain points, but often, these quick fixes only serve as a band-aid, postponing the inevitable need for a more comprehensive solution.

- Sustenance Mode: Many legacy systems are kept operational with minimal maintenance, focusing on essential tasks like fixing bugs and applying security patches. While this approach avoids major disruptions, it can lead to higher maintenance costs over time as the system becomes increasingly outdated. Over the years, I’ve managed systems that were in sustenance mode, and the continuous struggle with high maintenance costs and the inability to introduce new features efficiently was a constant challenge. The gradual accumulation of technical debt became a significant burden on the IT teams.

- Retirement and Replacement: Eventually, some banks decide to phase out or fully replace their legacy systems. This could involve migrating functionalities to a modern platform in stages or completely overhauling the system with a new, more scalable solution. Having overseen the retirement and replacement of legacy systems in multiple projects, I’ve found that while the initial phases are complex and require meticulous planning, the long-term benefits in terms of operational efficiency and customer satisfaction make the effort worthwhile.

Why Modernize? Key Drivers Behind the Shift

Several factors are pushing banks to modernize their core banking systems:

- Customer Expectations: Modern customers demand digital banking experiences that are fast, seamless, and personalized. Legacy systems often can’t support these needs.

- Regulatory Compliance: As regulations evolve, banks need systems that can quickly adapt to new requirements, which is challenging for outdated systems.

- Operational Efficiency: Maintaining legacy systems is costly and inefficient, especially when compared to the streamlined processes offered by modern technology.

- Competitive Pressure: The rise of fintech and digital banks means traditional banks must modernize to stay competitive.

- Scalability and Flexibility: Modern systems are built to grow with the business, easily integrating with emerging technologies like AI and blockchain.

- Security: Legacy systems often have security vulnerabilities that are harder to fix, making modernization essential for protecting against cyber threats.

- Technical Debts: Legacy systems accumulate technical debt over time, making them more difficult and expensive to maintain and evolve.

- Time to Market: Modern systems enable faster deployment of new features and services, helping banks respond quickly to market demands.

- Market & Revenue Growth: Modernizing systems can unlock new revenue streams by enabling innovative products and services.

- Technology Innovation: Leveraging modern technologies like cloud computing, AI, and APIs can drive innovation and improve service delivery.

- Specialized Skill Dependency: As legacy systems age, finding skilled professionals to maintain them becomes increasingly difficult and expensive.

Challenges in Modernizing Legacy Core Banking Systems

While modernization is crucial, it’s not without its challenges:

- Complexity and Risk: Core banking systems are complex, and any changes can risk downtime or data loss. In my overall experience throughout these years, I’ve learned that the complexity of these systems often results in significant risks during modernization. Any misstep can lead to operational disruptions, and careful planning is critical to minimizing these risks.

- Cost: Modernizing requires significant investment in new technologies and skilled personnel. Throughout my career, I have seen projects where initial cost estimates ballooned due to unforeseen complexities, underscoring the need for a well-thought-out budget and contingency plans.

- Cultural Resistance: Employees familiar with the old system may resist changes, complicating the transition. In my role as a project leader, I’ve encountered resistance from teams accustomed to legacy systems. It’s essential to involve key stakeholders early and provide training to ease the transition.

- Data Migration: Moving data from an old system to a new one is technically challenging. I have led multiple data migration projects, and each has presented its unique set of challenges, especially in ensuring data integrity and minimizing downtime.

- Integration with Other Systems: Legacy systems often have complex ties with other applications, making modernization difficult. Navigating these integrations has been one of the most intricate aspects of the projects I’ve managed. Ensuring that new systems seamlessly interact with existing ones requires extensive testing and validation.

- Monolithic Architecture: Many legacy systems are monolithic, meaning their components are tightly connected, making it hard to update or scale the system without affecting everything else. Over the years, I’ve worked on breaking down these monolithic architectures into more modular, flexible systems, but it’s a process that requires careful planning and a phased approach to avoid disrupting operations.

A Simplified Approach to Core Banking Modernization

Modernizing legacy core banking systems is crucial for banks to stay competitive and deliver better customer experiences. Here’s a simple guide to approaching this transformation:

1. Assessment and Planning

- Identify Business Needs: Start by understanding why your bank needs modernization. What are the specific goals driving this change?

- Evaluate Current Systems: Look at your existing systems to identify their limitations and what needs updating.

- Risk Assessment: Consider the potential risks and challenges of modernization, and plan how to mitigate them.

2. Developing a Modernization Strategy

- Incremental Modernization: Update parts of the system gradually, spreading out costs and reducing risks. In my experience, an incremental approach has often been the most effective, allowing us to address critical areas first while minimizing disruption. Look for low hanging fruits or minimum functionality that will not cause outages with modernization.

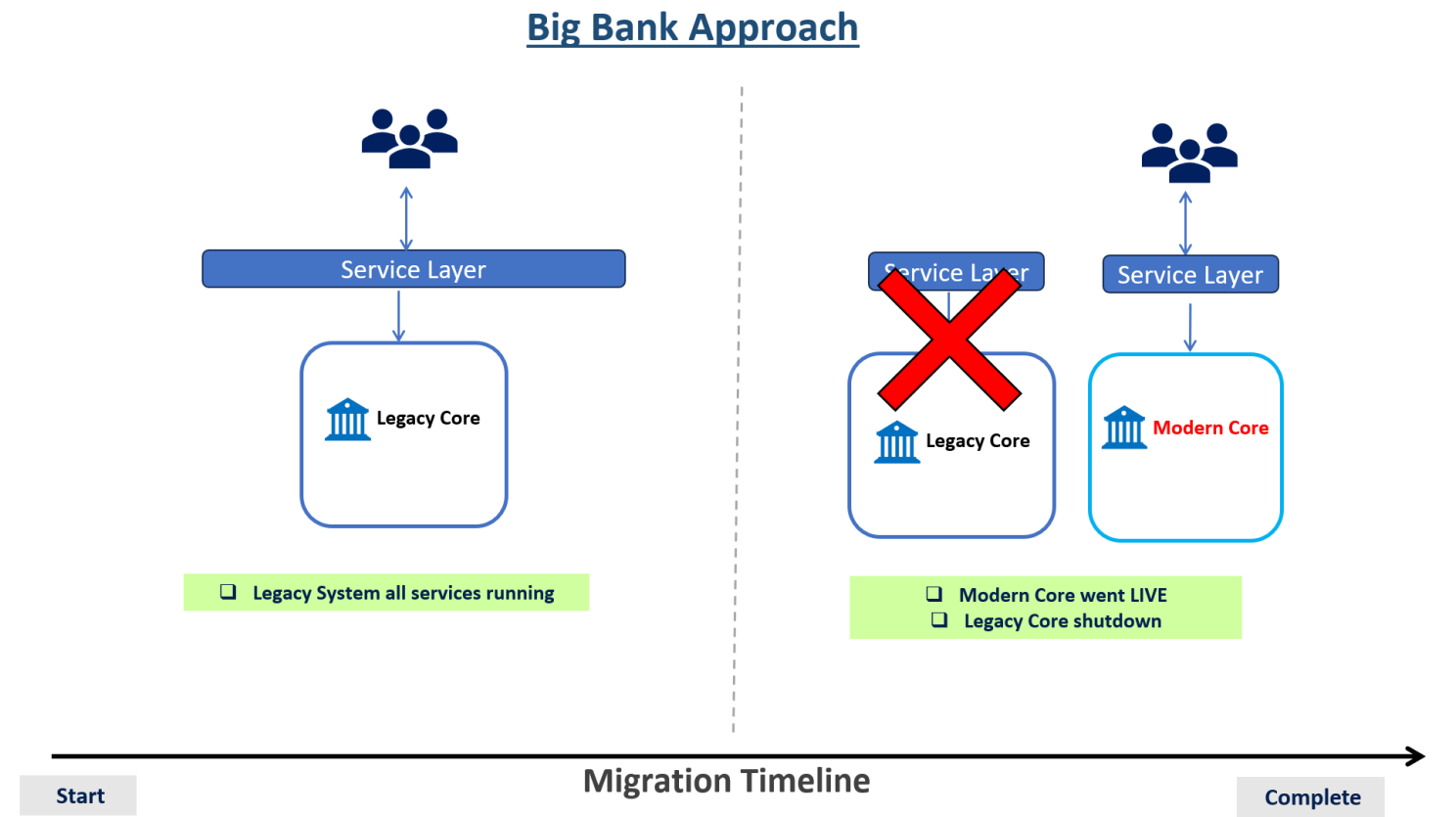

- Big Bang Approach: Replace the entire system in one go. It’s faster but comes with higher risks. I’ve led projects where a Big Bang approach was necessary due to regulatory pressures or competitive threats. While risky, it can deliver quick results if executed with precision.

- Parallel Approach: Run the new system alongside the old one to ensure everything works before fully transitioning. This approach has been invaluable in minimizing risks. Running parallel systems allows for thorough testing and validation before a full cutover, which I’ve found to be a crucial step in ensuring a smooth transition.

Let’s looks at the pros and cons between all three approaches at a glance.

3. Choosing the Right Modernization Method

- Re-platforming: Move your system to a modern platform, like the cloud, without changing its core functions.

- Rehosting: Shift your existing system onto a new, modern infrastructure.

- Refactoring: Rewrite parts of the code to improve functionality and efficiency.

- Replacement: Completely replace the legacy system with a new one.

- Greenfield Implementation: Build a completely new core banking system from scratch, typically in parallel with the legacy system until it’s ready for full deployment. I’ve had the opportunity to lead greenfield implementations, where starting fresh allowed us to design and deploy a system perfectly tailored to modern banking needs. This approach, though resource-intensive, provided the most flexibility and future-proofing.

- API Integration: Connect the legacy system with new technologies through APIs, allowing for gradual updates.

4. Different Modernization Approaches

- API-Driven Modernization: Use APIs to modernize gradually by building new services on top of legacy systems.

- Core Replacement: Replace the entire core banking system with a modern, cloud-native solution.

- Progressive Migration: Migrate components or modules to a modern platform in phases.

- Hollowing the Core: Gradually move non-core functions to modern platforms while retaining the core legacy system until the final phase of modernization.

- Cloud Adoption: Move the core banking system to the cloud for better scalability, security, and flexibility.

- Digital Decoupling: Separate digital services from the legacy core, allowing for modern customer experiences while maintaining the old system for back-end processes.

- Reengineering: Completely redesign and rebuild the system using modern technologies.

Co-Existence Strategies :

With Incremental / Phase wise and Parallel modernization approach the legacy Core Banking system will always exist. There are different co-existence strategies that helps to understand deep around modernisation .

Coexistence patterns are strategies used during the transition from a legacy system to a new system, where both systems operate simultaneously for a period. These patterns ensure business continuity, reduce risks, and allow for gradual migration. Below are different coexistence patterns, along with examples for each:

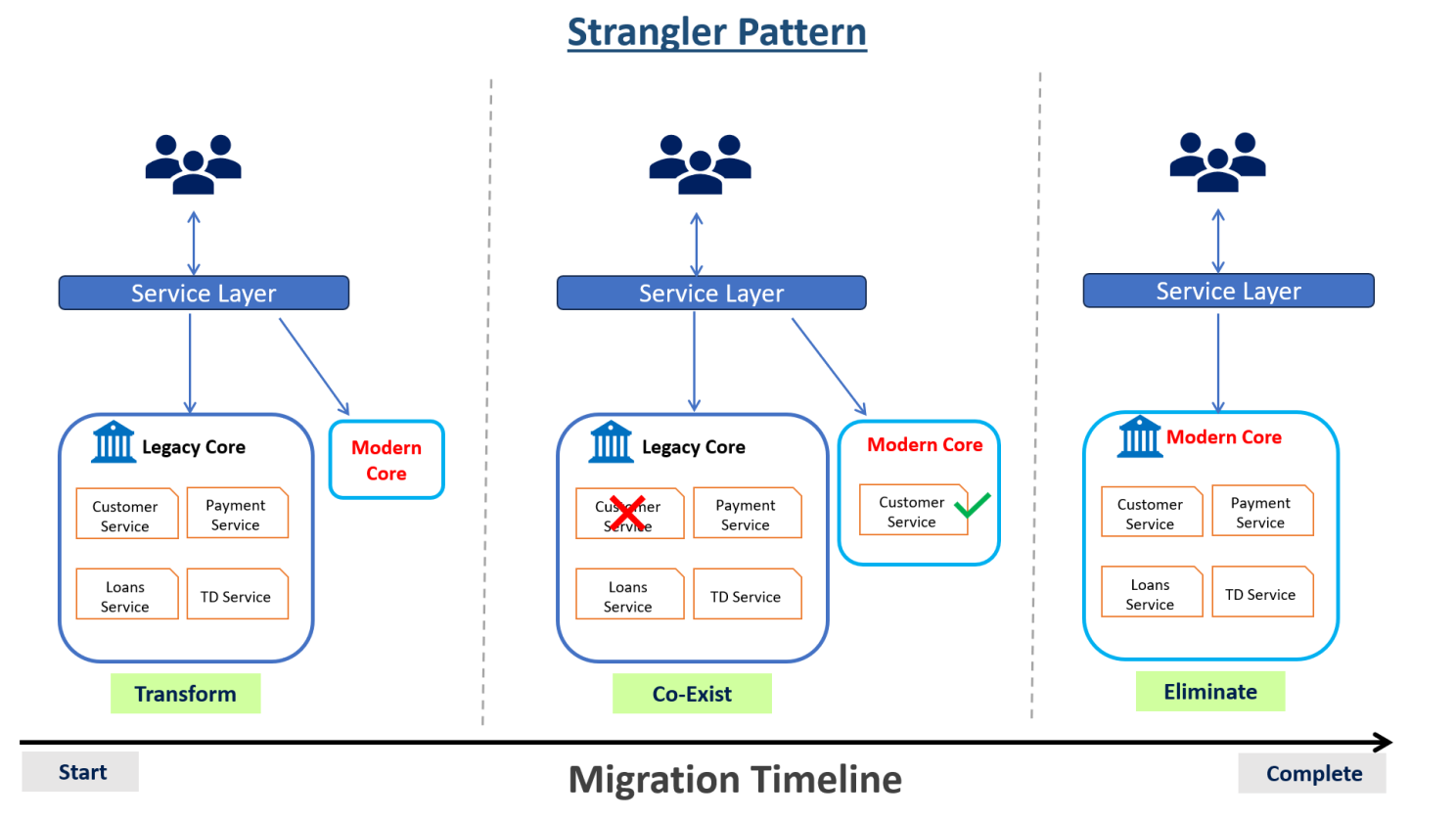

1. Strangler Pattern

- Description: The new system gradually replaces the legacy system piece by piece. Over time, the old system is “strangled” as more functionality is moved to the new system.

- Example: A bank gradually replaces its legacy core banking system by first moving the customer onboarding module to a new cloud-based solution. As the new system proves stable, other modules like loan processing and account management are also migrated. Eventually, the legacy system is retired completely.

2. Proxy Pattern

- Description: A proxy is used to route requests between the legacy and new systems. The proxy can direct traffic to either system depending on the functionality needed, enabling a seamless transition.

- Example: A bank introduces a new payments processing module. A proxy server routes payment-related requests; if the new system can handle the request, the proxy forwards it there. Otherwise, it sends the request to the legacy core banking system. As more features are added to the new system, the proxy directs more traffic to it until the legacy system is no longer needed.

3. Data Replication Pattern

- Description: Data from the legacy system is continuously replicated to the new system. Both systems operate on the same dataset, allowing for a phased transition.

- Example: A bank implements a new core banking platform but continues using the legacy system for some operations. Data from the legacy system is replicated in real-time to the new platform, ensuring both systems have identical customer and transaction data. As the new platform becomes more robust, it gradually takes over all banking operations.

4. Data Federation Pattern

- Description: The new system accesses data from both the legacy and new databases. This approach allows for data to be integrated without fully migrating it initially.

- Example: A bank launches a new customer relationship management (CRM) system within its core banking operations. Initially, customer data remains in the legacy database, but the new CRM federates the data, pulling information from both the old and new databases. Over time, data is progressively migrated to the new system, leading to a unified data environment.

5. Parallel Run Pattern

- Description: Both the legacy and new systems run in parallel for a specific period. Users gradually transition to the new system, with fallback to the old system if needed.

- Example: A bank deploys a new core banking system. During the first few months, both the new and legacy systems run in parallel. Transactions and customer operations are processed in both systems to ensure the new system’s accuracy and reliability. After the parallel run proves successful, the legacy system is retired.

6. Digital Decoupling Pattern

- Description: Digital channels (e.g., mobile apps, web portals) are decoupled from the legacy system and run on the new system while core processing remains on the legacy system.

- Example: A bank introduces a new digital banking platform that offers mobile and online services. While these digital services operate on a modern cloud-based system, core banking operations like transaction processing and account management continue on the legacy system. As more core functions are moved to the new system, the legacy system is gradually phased out.

7. Facade Pattern

- Description: A facade or wrapper is created around the legacy system, allowing it to interact with new systems as if it were a modern system. This pattern helps in gradually moving to the new system without changing the legacy system directly.

- Example: A bank needs to integrate a new loan management module with its old core banking system. Instead of overhauling the legacy system, a facade is built around it. The new loan management module interacts with the facade, which translates modern API calls into the legacy system’s format, allowing both systems to work together seamlessly.

Each of these coexistence patterns provides a structured approach to modernizing systems while ensuring continuity and minimizing risk during the transition. The choice of pattern depends on the specific requirements, existing infrastructure, and strategic goals of the organization.

Here’s how the various coexistence patterns fit into the three high-level strategies: Incremental Approach, Big Bang Approach, and Parallel Approach.

Below is the summary for the comparison:

- Incremental Approach: Strangler Pattern, Proxy Pattern, Data Replication Pattern, Data Federation Pattern, Digital Decoupling Pattern, and Facade Pattern fit well into this strategy. These patterns allow for gradual migration and modernization, where individual components or functionalities of the legacy system are progressively replaced or integrated with new systems.

- Big Bang Approach: None of the listed patterns typically fit into the Big Bang Approach. This strategy involves replacing the entire legacy system at once with a new system, without a coexistence phase. Big Bang transitions don’t generally rely on coexistence patterns because the entire old system is retired in one step.

- Parallel Approach: Strangler Pattern, Proxy Pattern, Data Replication Pattern, Data Federation Pattern, Parallel Run Pattern, Digital Decoupling Pattern, and Facade Pattern are suitable for this strategy. The parallel approach involves running the old and new systems simultaneously, and these patterns facilitate smooth operations during the coexistence period, allowing for testing, validation, and a fallback option if the new system encounters issues.

Conclusion

Modernizing core banking systems is challenging but essential. By carefully planning, choosing the right strategy, and leveraging modern technologies, banks can successfully navigate this transformation and remain competitive in a rapidly evolving industry. Considering my overall experience, I’ve seen how a well-executed modernization strategy can not only enhance operational efficiency but also position a bank to meet future challenges head-on. Modernization not only ensures operational efficiency but also aligns with the growing expectations of customers and regulatory bodies, making it a critical step for the future of banking.

Thank you !

For taking the time to read this article. I hope it provided valuable insights into the importance of modernizing legacy core banking systems and the various approaches that can be taken. Your interest in this topic is greatly appreciated!

If you found this article helpful, please click to like ,share and also comment if you have more insights around this topic.

If you haven’t read my previous articles, please follow the link below.

Banking Software Testing: Why It’s Critical and How to Get It Right

After working on multiple enhancements and implementations in various capacities, I’ve seen firsthand how issues sneak past different testing layers. Sometimes, testing teams miss crucial scenarios. Other times, developers don’t fully complete unit testing, assuming someone else will catch the gaps. And then—boom! Issues show up in Client UAT, Staging, or, even worse, Post-Go-Live. Time Vs Pressure inversely proportional to each other when issue occurs on the higher environments.

The result? Business disruption, financial losses, regulatory headaches, and frustrated customers. This raises some important questions:

- Who is responsible for what?

- What should individuals and teams learn from past mistakes?

- Are observations tracked to improve future releases?

- Is testing really that challenging, or is it about discipline and accountability?

Let’s break it down.

Regular Testing vs. BAU Testing in Banking IT

Every banking system, whether it’s a core banking platform, payment gateway, or fraud detection engine, requires rigorous testing before any change goes live. However, the type of testing varies depending on whether it’s a major product release or a minor fix.

# Regular Testing Cycle (Major Releases/Upgrades)

- Used for large-scale enhancements, system migrations, or core updates.

- Typically spans months, involving multiple rounds of testing.

- Includes functional, performance, security, and compliance testing to ensure stability.

# BAU (Business-as-Usual) Testing Cycle (Frequent Patches/Fixes)

- Used for minor enhancements, regulatory updates, or bug fixes.

- Shorter cycles (weeks or even days) with selective testing.

- Regression and UAT are critical to avoid breaking existing functionality.

Whether it’s a full-scale release or a quick patch, skipping proper testing can lead to disaster.

Remember the 2014 Bank of England CHAPS system outage? It disrupted high-value transactions for 10 hours! (Source)

Essential Testing Types for Any Banking Software

# Regular & BAU Testing (Must-Have for All Releases)

- Unit Testing – Developers verify individual code components.

- Integration Testing – Ensures different modules work together.

- Functional Testing – Validates if business logic works correctly.

- Regression Testing – Ensures new changes don’t break existing functionalities.

- UAT (User Acceptance Testing) – Business users confirm if requirements are met.

# Optional & Need-Based Testing (For Complex Releases) (NFR)

- Performance Testing – Required for high-traffic apps like mobile banking.

- Security Testing – Mandatory for new authentication methods or APIs.

- Compliance Testing – Needed for SWIFT, ISO 20022, or regulatory updates.

Why So Many Testing Layers?

Every banking feature—whether it’s a new UPI AutoPay option, a fraud detection model, or a real-time cross-border payment service—must go through multiple rounds of testing before deployment.

Why? Because banking software is complex, highly regulated, and cannot afford failures.

Each type of testing plays a crucial role in ensuring smooth functionality. Here’s how the testing journey unfolds for any banking feature:

Where Do Issues Usually Emerge? Who Is Responsible?

Testing failures can occur at any stage, but who should take ownership? Here’s a reality check:

- Missed unit tests? → Developers are accountable.

- Missed integration or functional tests? → Test teams should have caught it.

- Missed real-life scenarios? → UAT teams must document these better.

- Missed regulatory compliance? → Business and regulatory teams must step up.

But let’s be honest: Testing is a shared responsibility.

What Can We Learn from This?

- Developers must ensure unit tests cover all edge cases.

- Testers must think like end users and anticipate real-world scenarios.

- UAT teams must track and document missed cases for future releases.

- Organizations should perform root cause analysis to prevent recurring issues.

The BIG question is: Are these testing gaps documented and analyzed? If not, the same mistakes will repeat across future releases.

Commonly Overlooked Test Scenarios in Banking Software

Best Practices for Banking Software Testing

Over the years, coming from a development background, I’ve observed firsthand the gaps and challenges in testing. Having seen the impact of missed scenarios and inadequate validations, I’ve identified key best practices that significantly reduce defects and enhance system stability:

- Start Testing Early – Identify defects at the earliest stage to reduce the cost of fixing them later.

- Use Risk-Based Testing – Prioritize critical banking functions (e.g., payments, security) to ensure no major breakdown.

- Automate Where It Makes Sense – Don’t try to automate everything; focus on regression, API, and performance testing.

- Keep UAT Business-Driven – Ensure real users validate the system from a business and customer perspective.

- Monitor & Learn from Past Defects – Track missed defects and improve test coverage for future releases.

- Encourage a Culture of Ownership – Testing is not just a QA responsibility; developers, business analysts, and stakeholders should all take accountability for quality.

My Final Thoughts

Despite advancements in technology and the rise of automation in testing, challenges persist. We have sophisticated frameworks, AI-driven testing, and extensive automation suites—yet defects still slip through. Why? Because testing isn’t just about tools, it’s about understanding systems, identifying patterns, and anticipating failures before they happen.

Every bank has unique architectural complexities, integrations, and business workflows that don’t always fit into standard automation scripts. Some issues arise from real-world concurrency scenarios, unexpected user behaviors, or migration inconsistencies—things that are hard to predict and even harder to automate.

Testing is not just a phase; it’s a continuous discipline that requires domain expertise, structured test design, and proactive validation to keep banking systems stable, secure, and customer-friendly.

At the end of the day, testing is not about blaming who missed what—it’s about building a culture of quality, accountability, and continuous improvement. Every defect that slips through is an opportunity to strengthen the process, not point fingers.

In banking, where even a small glitch can cause financial loss or regulatory trouble, everyone—developers, testers, business analysts, and operations teams—plays a role in ensuring smooth, error-free releases. The focus should always be on collaboration, learning from past mistakes, and making the system stronger with each release.

Quality is a shared responsibility, and when done right, it leads to seamless banking experiences, happy customers, and a resilient system.

What do you think? Have you experienced post-go-live issues due to missed testing scenarios?

Share your insights and experiences around this.

Banking Architecture Modernization : From Monolith to Microservices in Banks

Overview :

Stability used to be the gold standard in the Core Banking industry. Systems were intended to be large, integrated platforms that could manage a whole bank from a single, closely-knit codebase. These platforms took care of everything, including processing high-value payments, creating end-of-day reports, and managing loans and accounts.

These monolithic systems provided dependability and consistency across branches, nations, and currencies for many years. I was lucky enough to get a chance to work on Oracle FLEXCUBE implementations in EMEA region for more than 20 years, I can confidently speak to the strength of Oracle Banking Offerings — from legacy systems to their latest digital solutions and SaaS based offerings.

However, in recent times , with the rapid evolution in banking solutions — things have changed drastically

Banks are now expected to be agile tech players rather than merely service providers. Consumers desire instant resolutions, highly customized services, and real-time experiences. Business teams, meanwhile, want to scale digital channels smoothly, react to regulations swiftly, and introduce features more quickly.

The difficulty starts at this point.

Conventional monolithic architecture finds it difficult to meet the demands of the modern world. Microservices architecture comes into play here, not as a trendy term but as a survival tactic for banks looking to maintain their lead.

Let’s understand this architectural change from monoliths to microservices in detail using core banking systems as a guide.

What is a Monolith in Core Banking?

Prior to the popularity of microservices, core banking systems were constructed as monoliths, which were composed of a single, tightly integrated software stack with all of the components living together:

- Account management

- Payments and transfers

- Loans and credit

- Statements and reporting

- Customer onboarding

- Compliance and alerts

A monolithic core consists of a single deployable unit that contains the entire system. It’s easy at first, but things get complicated over time. More code, more database tables, and more connections are created with each patch, enhancement, and business feature. The system eventually becomes a single, enormous, interconnected web.

The outcome?

- Difficult to understand

- Painful to test

- Risky to change

Nearly impossible to scale specific functions

A small interest rate change in the Loans module could unintentionally break Reporting or impact batch processing overnight. I’ve experienced it personally, particularly with complicated customizations for banks in the Middle East and Africa.

Why Change? The Case for Microservices

These days, banking is about speed, scale, and service personalization rather than just stability.

Consumers anticipate:

- Updates in real time

- Real-time updates

- 24×7 access

- Instant onboarding

- Seamless digital experiences

What Are Microservices in a Banking Context?

Let’s break it down simply:

- “Micro” = Small

- “Service” = Performs a specific function

Together, microservices are compact, self-contained services that do one thing well:

- A service for managing customer details

- Another for payments and settlements

- One for loan eligibility and EMI schedules

- Yet another for sending alerts and notifications

They run independently, often on separate machines or containers, and talk to each other via APIs or event queues.

The Architecture Layers :

Let’s now look at the architecture layers involved in both systems:

Monolithic Architecture Layers :

- Presentation Layer (UI): Thick-client or web-based interface (often proprietary), tightly linked with business logic.

- Business Logic Layer: Core logic for all banking products and processes, bundled together.

- Integration Layer: Connectors for channels, interfaces, or external services (usually point-to-point).

- Data Access Layer: Direct connection to a centralized relational database.

- Database Layer: A single database schema with all modules sharing tables and logic.

Monolithic Architecture

Microservices Architecture Layers

- API Gateway Layer: Entry point for all clients. Routes requests to relevant services, applies authentication, throttling, etc.

- Service Layer (Microservices): Each microservice encapsulates a domain-specific function (e.g., Customer, Loans, Payments).

- Integration Layer: Event buses (Kafka), message queues, and RESTful APIs ensure communication between services.

- Database Layer: Each service has its own data store (SQL/NoSQL) with no direct sharing.

- DevOps/CI-CD Layer: Automated pipelines for build, test, deploy, and monitor.

- Observability Layer: Centralized logging, metrics, and alerting for each service.

Microservices Architecture

Key Microservices Examples in Core Banking Systems

In order to better understand microservices, below are some key examples. These examples are structured across the six architectural layers in a Core Banking System.

Customer Microservice

Account Microservice

Payment Microservice

The Journey – How Banks Transition

Banks don’t “flip a switch” to go from monolith to microservices. It’s a progressive journey. From my experience, here’s what it typically looks like:

Microservices Transition Journey

I remember helping a bank around legacy systems to extract their Alerts module from Core Banking System, moving it to a standalone event-driven microservice. This simple move allowed them to integrate with SMS/Email/WhatsApp and scale independently during peak periods , something impossible in the earlier setup.

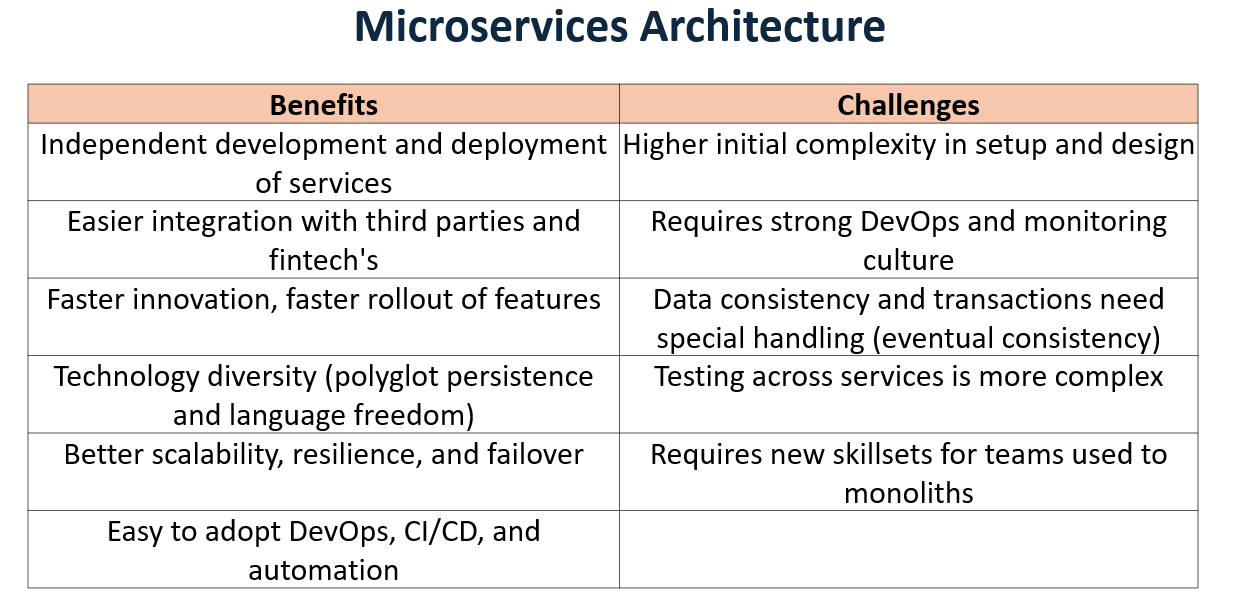

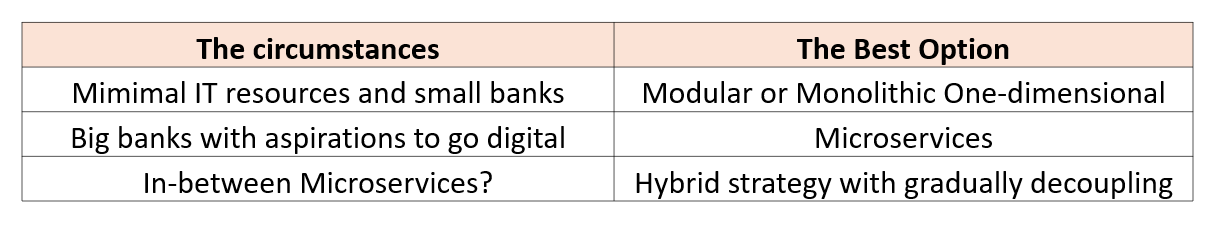

Benefits and Challenges

During my support years, even minor hotfixes required entire deployment cycles. A fix in the CASA module triggered regression testing in 5 other modules.

In recent time as part of digital transformation initiative in a Bank, when we built a new Loans Origination microservice, it exposed the team’s need to re-learn deployment pipelines, observability tools, and asynchronous data handling.

Which Is Better, Monolith or Microservices?

No “one-size-fits-all” solution exists.

The Innovation Beyond

Once the microservices backbone is in place, a world of innovation opens up:

- Composable Banking: Combine different services into new offerings quickly.

- BaaS (Banking-as-a-Service): Offer core functionality to partners and fintech’s via APIs.

- AI-Enhanced Banking: Integrate ML-based fraud detection, customer insights, and smart product recommendations.

- Multi-cloud Deployments: Scale services across geographies with cloud-native resilience.

- Digital Currencies & Blockchain: Plug into tokenized assets and distributed ledgers with modular services.

Final Thoughts

Monoliths gave us stability. Microservices give us speed. But the true strength lies in understanding the context, the need, and the timing. In the fast-changing world of banking, there’s no one-size-fits-all solution. Every architecture decision should be rooted in business needs, customer expectations, and operational readiness.

For banks aiming to stay competitive and innovative, the message isn’t to tear everything down – it’s to modernize with intent.

Don’t rush into microservices for the sake of trend. Start small. Break down the monolith thoughtfully. Introduce modularity where it makes sense. Use APIs to gradually expose functionality. Build confidence through incremental success.

This isn’t just about technology. It’s about culture, ownership, and how teams think and collaborate.

Having spent more than two decades working across global banking projects—especially within Oracle FLEXCUBE landscapes—I’ve seen firsthand how architectural decisions ripple across systems, teams, and customer experiences. I got a chance to work on everything from new product rollouts and regulatory upgrades to post-go-live support and mission-critical troubleshooting.

And if there’s one thing these years have taught me, it’s this:

“The strength of a system isn’t in how it handles good days—it’s in how it survives the unexpected ones”

As banks step into the next era of digital transformation, I believe success will belong to those who build with clarity, ownership, and long-term thinking – whether that’s in monoliths, microservices, or a thoughtful mix of both.

The journey isn’t easy – but with the right mindset, the right partners, and a clear architectural vision, it’s absolutely worth it.

Let’s build systems that are not just smart—but sensible.

What’s your take on Core Banking architecture? Did you got a chance to explore and participate this transition ?

Would love to hear your stories and experiences in the comments to gain more insights towards this crucial but very important topic.

How Banks Decide How Much to Lend — A Simple Explanation of Line , Limits & Collateral

After spending many years in Core Banking programs, and then going a step deeper by researching how enterprise risk systems actually work behind the scenes, one important thing became very clear to me:

Banks are not really only in the business of giving money. They are in the business of managing risk while giving money.

Loans, overdrafts, letters of credit, bank guarantees, trade finance, treasury exposure — on the surface these all look like different products. But beneath all of them, there is just one common question:

How much risk is the bank taking on this customer, and is that risk under control?

To manage this, banks use a Central Limits & Collateral Control System (commonly known as ELCM), which works tightly integrated with the Core Banking System (CBS).

Customers may never hear this term. Many bankers may not deal with it daily.

But without CBS + ELCM working together, a bank is like a car speeding down a highway with no brakes — sooner or later, it’s going to hit a tree it never saw coming.

Let me explain this using a simple real-world business situation that most of us can relate to.

A Simple Business Situation We All Can Relate To

Let’s imagine a growing company called ABC Industries.

As the business expands, ABC approaches the bank for different needs:

- A Term Loan processed through Core Banking (CBS – Loan module)

- An Overdraft managed in CBS

- A Letter of Credit (LC) handled in the Trade Finance system

- A Bank Guarantee (BG) handled in the Guarantee / Trade system

Now pause for a moment and think from the bank’s technology side. These products run on:

- Core Banking System (CBS)

- Trade Finance System

- Treasury System

- Digital Channels

If all these systems work independently, then who is watching this one most important question:

What is the total risk exposure of the bank on ABC Industries across ALL systems?

If no single system has this full picture in real time, this is exactly how banks slowly move into large credit losses. And this is the exact problem that ELCM was designed to solve.

What ELCM Really Means in a Core Banking World

ELCM stands for Enterprise Limits & Collateral Management.

In simple banking language: ELCM is the central risk engine that works alongside CBS and decides how much can be given, against what security, and to whom — across the entire bank.

No matter where a transaction starts:

- CBS (Loans, OD, CC)

- Trade Finance (LC, BG)

- Treasury

- Forex

Everything must pass through ELCM for risk validation.

The Three Pillars That Drive ELCM

To understand ELCM properly, especially in a Core Banking environment, we must understand three basic concepts:

- Limits – How much exposure CBS is allowed to create

- Collateral – What security backs those CBS facilities

- Exposure – How much risk is already consumed across CBS, Trade & Treasury

What Is a Limit in Banking?

A Limit is the maximum financial exposure a bank is willing to take on a customer or a group. It represents the highest amount the bank is comfortable risking, based on:

- Credit assessment

- Financial strength

- Collateral offered

- Business requirement

- Regulatory policies

In simple words:

A limit is always approved centrally and applies across all banking products — loans, overdrafts, LC, BG, etc.

What Is Limits Management in Core Banking?

Once a limit is approved, the bank must control how that limit is used. This entire process is called Limits Management, which includes:

- Defining how much a customer is allowed to borrow

- Allocating product-wise lines (Loan line, OD line, LC line, etc.)

- Controlling how much of the limit is consumed

- Tracking the available balance in real time

- Blocking or approving new transactions based on usage

- Ensuring no transaction crosses the bank’s risk boundary

In simple words:

It is the mechanism that keeps lending safe, controlled, and within policy, especially when multiple systems (CBS, Trade, Treasury) are involved.

Limit vs Line (Pizza Model)

A Line is a portion of the total limit reserved for a specific product.

For example:

- Total approved limit = ₹50 Cr

- This is split as: Term Loan Line → ₹25 Cr Overdraft Line → ₹15 Cr LC Line → ₹10 Cr

So in simple words:

Both are checked before any money is released.

Different Types of Limits Banks Use Every Day

In real-world banking operations, limits are structured around how a business actually functions — its growth plans, daily cash flow needs, trade activities, and even seasonal trends. Some of the most commonly used limits include:

- Term Loan Limits – for long-term expansion

- OD Limits – for daily working capital

- LC Limits – for imports and trade

- BG Limits – for contracts and tenders

- Temporary Enhancement Limits – for seasonal spikes

- Group-Level Limits – for business groups with multiple companies

How Lines and Limits Work Together in Real Life

Let’s take a simple example.

ABC Industries is a large manufacturing company. The bank approves a total credit line (overall exposure line) of ₹70 Cr for this customer. This single line is then split into product-wise limits like this:

- Term Loan Limit: ₹40 Cr

- Overdraft (OD) Limit: ₹20 Cr

- LC Limit: ₹10 Cr

Here, ₹70 Cr is the total Line, and ₹40 + ₹20 + ₹10 are individual Limits under that Line.

Current Utilization Under the Line

Over a few months, ABC Industries starts using these limits:

- Term Loan used: ₹30 Cr

- OD used: ₹10 Cr

- LC used: ₹5 Cr

So now:

- Total used across the line = ₹45 Cr

- Total available under the line = ₹25 Cr

What Happens When a New Transaction Comes In?

Now someone tries to open a new LC for ₹30 Cr.

- Even though the LC limit was originally ₹10 Cr,

- And even if the business unit tries to process it in the Trade system,

- The overall Line still has only ₹25 Cr available.

Since the new request is ₹30 Cr and available line is only ₹25 Cr, The system will automatically block the transaction.

Limits check & Processing

This real-time validation is done by ELCM, even though:

- The loan flows from CBS, and

- The LC is processed in the Trade system.

Why Limits Management Is So Critical

Without strong limits control:

- Customers over-borrow

- Risk keeps building quietly

- Exposure is visible only during audits

- Losses appear suddenly

With proper ELCM:

- Every transaction is checked instantly

- Risk stays within control

- Management always knows true exposure

- Growth remains safe and disciplined

What Is Collateral – And Why CBS Depends on It

At its simplest, collateral is a promise backed by something valuable. It gives the bank a way to recover money if a borrower cannot pay. Collateral is not just paperwork — it’s real economic value that supports lending decisions.

Common types of collateral include:

- Property or land — factory buildings, warehouses, commercial plots

- Fixed deposits — bank FDs often accepted as clean, liquid security

- Shares or mutual funds — market-linked assets that need frequent revaluation

- Machinery or equipment — physical assets used in production

- Corporate or promoter guarantees — promises backed by another company or person

Why does this matter to the Core Banking System (CBS)?

Because CBS is the system of record for loan accounts — it creates the loan, posts disbursements, schedules repayments and interest, and records customer balances. But CBS by itself does not manage the lifecycle of the security: who owns it, when it was valued, whether a haircut applies, whether it has been pledged to another bank, or whether the legal charge is in place. That detailed, regulatory-safe handling of security is the job of ELCM.

Put simply:

- CBS moves money and records the account activity.

- ELCM owns the collateral, tracks its value, enforces haircuts and margins, and ensures the security legally backs the loan.

Why Banks Insist on Collateral

Banks insist on collateral for one simple reason — they are not lending their own money. They are lending money that belongs to depositors, pension funds, and the general public. That money must be protected at all times.

Collateral helps banks because:

- They lend depositors’ money – Every loan carries a responsibility to safeguard public funds.

- They must protect their own capital – If many borrowers default at the same time, the bank’s financial stability can be at risk.

- They must be ready for economic shocks – Recessions, market crashes, and business failures can happen suddenly. Collateral acts as a cushion during such times.

- It enforces financial discipline – When borrowers pledge valuable assets, they are more careful about repayments.

- It reduces overall credit risk – Even if a loan turns bad, the bank still has a path to recover part or all of the money.

In simple words, collateral is what gives banks the confidence to lend at scale — safely and responsibly.

What Is Collateral Management (Beyond CBS)?

Collateral management is not just tagging a property to a loan and forgetting it.

It includes:

- Market valuation

- Haircuts

- Revaluation

- Margin tracking

- Expiry monitoring

- Release and reuse

Collateral sits at the center of this partnership.

One Collateral, Multiple Banking Facilities

Now let’s look at how a single collateral can support multiple banking facilities at the same time — something that happens every day in real banks.

ABC Industries offers a commercial property with a market value of ₹100 Cr as collateral to the bank. As per the bank’s risk policy, a haircut is applied to protect against market fluctuations. After this haircut, the bank decides that only ₹70 Cr of this value is safely usable as effective collateral.

Now, instead of using separate security for every loan, the bank smartly uses this same ₹70 Cr collateral across multiple facilities:

- ₹40 Cr Term Loan for long-term business expansion (handled in CBS)

- ₹20 Cr Overdraft (OD) for daily working capital needs (handled in CBS)

- ₹10 Cr Letter of Credit (LC) for imports and trade activities (handled in the Trade system)

Here’s what is important behind the scenes:

- All limits and collateral usage are approved in ELCM

- All actual disbursements and transactions happen in CBS or Trade

- ELCM continuously tracks how much of the collateral is already consumed

- The moment the ₹70 Cr usable value is fully utilized, no new facility will be allowed

So even though the customer sees three different products — Loan, OD, and LC — the bank sees only one thing: total risk covered by one common collateral pool, centrally governed by ELCM.

This is how banks ensure:

- No over-leveraging on the same asset

- No hidden risk across systems

- And complete control over credit exposure in real time

Who Is Involved in a CBS–ELCM Ecosystem?

- Relationship Managers

- Credit Teams

- Legal Teams

- CBS Operations

- Trade Operations

- Risk Teams

- Audit & Compliance

How CBS and ELCM Work Together to Control Risk (Conceptual View)

To truly understand how risk is controlled in real time, it’s important to first see how Core Banking (CBS) and ELCM work together conceptually in every single transaction.

No matter whether it’s a loan, overdraft (OD), letter of credit (LC), or bank guarantee (BG) — the request always passes through a controlled enterprise-level approval loop before any money is released.

CBS may be the system that executes the transaction, but ELCM is the system that validates whether the risk is allowed at all. This tight integration ensures that business growth never runs ahead of risk control.

Here’s how this collaboration translates into a real-life system flow.

The Complete CBS ↔ ELCM Workflow (Transaction Execution View)

This is where everything comes together in real time. Every single lending transaction in a bank follows this exact validation path before money actually moves.

Behind the scenes:

- CBS executes

- ELCM decides whether the risk is acceptable

Step-by-Step Flow:

- A loan is created in CBS

- CBS sends a real-time request to ELCM

- ELCM checks: Available limit , Available collateral coverage , Group exposure

- Approval is sent back to CBS

- CBS disburses the amount

- ELCM instantly updates the total exposure

Why Strong Limits & Collateral Control Truly Matters

A bank can modernize its Core Banking System. It can digitize lending. It can automate trade finance and payments.

All of this looks impressive on the surface.

But based on what I have seen and experienced, if limits and collateral are not centrally controlled through ELCM, then the bank’s real risk still remains scattered across systems—quietly building up in the background.

ELCM may never appear on a mobile app. Customers may never see it. But at the exact moment when money is about to move, ELCM quietly steps in to validate, control, and protect the bank.

Final Thought

In my opinion, if Core Banking is the heart of a bank, then ELCM is the silent control system that keeps that heart safe and steady.

Every single day—across every loan, LC, BG, and overdraft—ELCM ensures that lending happens with control, confidence, and discipline, even when volumes are high and business pressure is real.

When risk is controlled quietly in the background, that’s when a bank is truly doing its job well.

If this article connected with your experience, do give it a like. And I’d honestly love to hear your views and real-life experiences around Limits, Collateral, or ELCM in your organization.