Existing Customer CLV Formula

A fairly standard CLV formula that you will find for measuring the lifetime value of existing customers is:

CLV = (m.r)/(1+d-r)

- Where m = customer margin (or profit contribution) per year

- Where d = discount rate

- And r = retention/loyalty rate per year

Important note: This formula is designed to measure the customer lifetime value of EXISTING customers only. You should also note that there is NO use of an acquisition cost, as existing customers have already been acquired and that expense is now historical (or a sunken cost).

How this CLV formula for existing customers works

To make sense of what this formula is doing, let’s first look at the bottom line of 1+d-r, but remove the discount rate (d) and we are now left with 1-r.

We should know that 1 minus the retention rate is churn (or customer loss) rate. When we use the churn rate at the bottom (denominator) of the fraction/equation, we are actually calculating the lifetime period of a customer in years.

- For example, a 60% loyalty rate = 40% churn/loss = 1/0.4 = 2.5 years, and

- An 80% loyalty rate = 20% churn/loss = 1/0.2 = 5 years

Now let’s look at the impact of the retention rate at the top of the equation. At the top of this CLV formula (numerator) there is m times r. This has the immediate impact of reducing the margin (profit) to the likely margin be be achieved in the FOLLOWING year.

This occurs because the formula is looking at an existing customer (already acquired) and estimating their FUTURE value – not their total value over the course of their customer relationship.

To make sense of this difference, let’s compare a new customer’s CLV to an existing customer.

The new customer is shown on the left hand side. As you can see, their acquisition cost was $500 in Year 0, their margin was $300 in Year 1, which then reduces by 60% each year in line with estimated retention rates.

After the 10% discount rate, their CLV (shown as DCF = discounted cash flow) is $160.

On the right hand side of the table, the CLV figures are shown for an existing customer using the above formula.

As you can see, there is NO acquisition cost (as they are already a customer), and we essentially start the customer in Year 2 with a annual margin of $180 (which is 60% of Year One’s $300 – note the two highlighted yellow cells).

In this case, the customer value (after discounting) is $360. This is also what the above formula tells us:

- CLV = (m.r)/(1+d-r) = (300 X 60%)/(1+.1-.6) = 180/0.5 = $360

LIMITATIONS OF THIS CLV FORMULA

The main concern with this approach to calculating customer lifetime value is its use of static values. Firstly, it assumes a stable margin (annual customer profit), which is generally unlikely (please see article on increasing customer revenues). And secondly, it also assumes a stable loyalty rate over time, which again is generally unlikely.

That’s why the free CLV Excel template available on this website allows for flexible revenues, costs and margins over time.

So why use this CLV formula?

CLV = (m.r)/(1+d-r) is appropriate as a simple estimation of future customer value. It can be easily applied to a customer database (say in a spreadsheet format) where the customer’s profit/margin for the year is listed, along with an estimated loyalty/retention rate.

This CLV value becomes a forward-looking metric that a marketer can use to determine the financial viability of various cross-selling and loyalty focused marketing tactics.

Related Topics

Customer Lifetime Value: Existing versus new customers

Are you measuring the CLV of existing or new customers?

Customer lifetime value calculations, and the most suitable CLV formula to use, will vary depending upon what type of customer that you are attempting to measure. To make this point quite simply, there are two main types of customers that we are seeking to measure for customer lifetime value purposes, which are:

- Existing (current) customers, or

- Potential (new) customers (which will also include re-acquiring lost or lapsed customers).

KEY CLV FORMULA DIFFERENCES BETWEEN EXISTING AND POTENTIAL CUSTOMERS

There is a significant different in the CLV calculation for these two categories of customers. The most significant difference is in regards to the treatment of the acquisition cost. Obviously, existing customers have already been acquired – hence their acquisition cost is essentially a sunken cost that we would not take into account. Whereas new/potential customers still need to be acquired and will incur an acquisition cost.

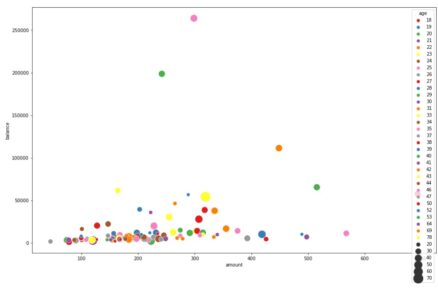

The second difference is that the loyalty (retention) rate of existing customers is likely to differ between existing and new customers. To make sense of this retention rate difference, let’s consider this graph of customer loyalty over time.

The first arrow on the left shows the loyalty rate for (new) customers after the first year of just 60%, whereas the arrow on the right shows the loyalty rate of existing customer (in years 7-8) approaching 80%.

The first arrow on the left shows the loyalty rate for (new) customers after the first year of just 60%, whereas the arrow on the right shows the loyalty rate of existing customer (in years 7-8) approaching 80%.

So why does this happen? When you think about it, the loyalty rate pattern makes logical sense.

At the start (year 1), new customers are essentially trialing the brand’s/firm’s offering. If they are dissatisfied (or a consumer more prone to switching), then they are more likely to churn (switch or lapse) early in their brand relationship. However, if they are satisfied with their initial purchase and remain loyal after the first year, it is likely that the loyalty rate of the remaining customers will increase over time (as the less satisfied customers decide to discontinue or switch brands).

EXAMPLE OF DIFFERENT CLV CALCULATIONS: NEW VERSUS EXISTING CUSTOMERS

To make the customer lifetime value calculation as simple as possible, let’s assume:

- The acquisition cost of new customers is $1,000

- The customer profit (revenues less appropriate costs) is $500 per year

- The loyalty rate of new customers is 60% (as per the above table, which = 2.5 years)

- And the retention rate of existing customers is 80% (say for year 9 in the table above, which = 5 years)

Therefore, the customer lifetime value of NEW customers would be:

- $500 X 2.5 years, less $1,000 = $250

And the CLV of EXISTING customers would be:

- $500 X 5 years = $2,500

What do these CLV results mean?

As you can see, the customer lifetime value for existing customers is 10 times the value for new customers. However, this is to be expected. Due to the loyalty rate pattern for this example (60% increasing to 80%+ retention), there is only a small number of existing customers after ten years.

Let’s now look at the percentage of customers that actually remain loyal for ten years (even with a retention rate of 60-80%). As you can see in the graph, only around 5% of customers are still with the firm/brand at the ten year mark.

Let’s now look at the percentage of customers that actually remain loyal for ten years (even with a retention rate of 60-80%). As you can see in the graph, only around 5% of customers are still with the firm/brand at the ten year mark.

These customers are highly loyal (most probably due to choice, rather than habit at this stage) and therefore should be quite profitable ongoing.

And compared to the less loyal newer customer, their CLV figure will be naturally higher. But keep in mind that within every cohort of new customers there will be very short-term low value customers, as well as a small number of long-term high value customers.

IMPACT ON NEW VERSUS EXISTING CUSTOMER ACQUISITION STRATEGY

Based on the differing CLV’s of new versus existing customers, there is possibly a suggestion that the best strategy would be to focus on existing customer only. But you are probably aware of the leaky bucket theory – which suggests that even with high retention rates there will always be a drain on customer numbers (as illustrated in the previous chart).

Therefore, the clear strategy should be to continue with new customer acquisition, with the intent of identifying (or creating) the long-term, high value customer than underpins the ongoing profitability of the firm or brand.